CryptoBull.org Mid-October Market Update: Buckle Up!

Greetings, fellow crypto enthusiasts! It's that time again for your mid-October crypto market update from your trusted source, CryptoBull.org. Hold on tight, because things are moving fast!

Bitcoin's Bullish Run Continues:

The big daddy of crypto, Bitcoin (BTC), is showing impressive strength, recently breaking the $68,000 mark! This surge is fueled by a mix of factors, including increased institutional adoption, growing concerns about traditional finance, and the upcoming Bitcoin halving event. While some analysts predict a minor correction, the overall sentiment remains bullish.

Altcoins Are Heating Up:

It's not just Bitcoin making waves. Many altcoins are experiencing significant gains. Ethereum (ETH) is steadily climbing, Solana (SOL) is showing strong momentum, and meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) are seeing surprising surges, likely driven by social media buzz and speculation.

Key Trends to Watch:

Increased DeFi Activity: Decentralized finance (DeFi) continues to attract investors, with new projects and protocols emerging regularly. Keep an eye on this space for potential high-growth opportunities.

NFT Evolution: The NFT market is evolving beyond simple collectibles. We're seeing increased utility in areas like gaming, metaverse development, and digital identity.

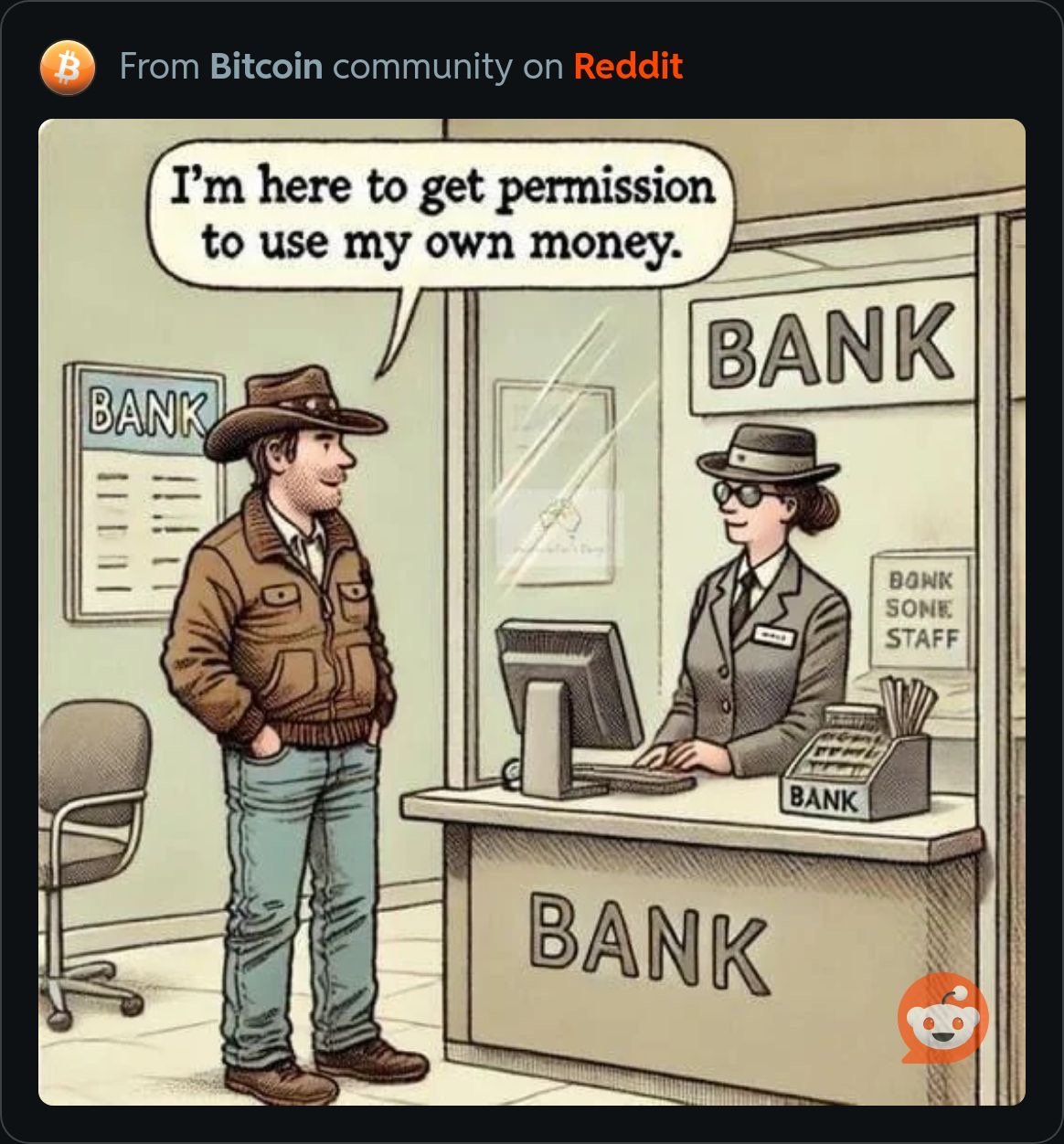

Regulation on the Horizon: Governments worldwide are working on cryptocurrency regulations. While this could bring more stability to the market, it's essential to stay informed about potential impacts on your investments.

Our Bullish Picks for October:

While the entire market seems to be gaining momentum, here are a few cryptos that we believe have particularly strong potential this month:

Solana (SOL): With its fast transaction speeds and scalability, Solana is well-positioned to capitalize on the growing DeFi and NFT markets.

Chainlink (LINK): As the leading oracle network, Chainlink plays a crucial role in connecting smart contracts to real-world data, making it a vital component of the expanding blockchain ecosystem.

Bitcoin (BTC): Bitcoin is likely to really take off if it can sustain growth and cross resistance at $69k, you’ll want to have a strong stack of satoshis to ride this wave.

Important Reminder:

As always, remember that the crypto market is highly volatile. Do your own research (DYOR) before investing, and only invest what you can afford to lose.

Stay tuned for more updates and insights from CryptoBull.org. Happy investing!

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice.