Introduction:

Cryptocurrencies have revolutionized the financial landscape, and with their increasing popularity, the demand for reliable information and trustworthy platforms has grown exponentially. As a result, cryptocurrency websites have evolved significantly over the years, not only in terms of design and functionality but also in their visibility on search engines like Google. In this blog, we will explore the fascinating journey of cryptocurrency websites and shed light on how Google's search engine ranks them.

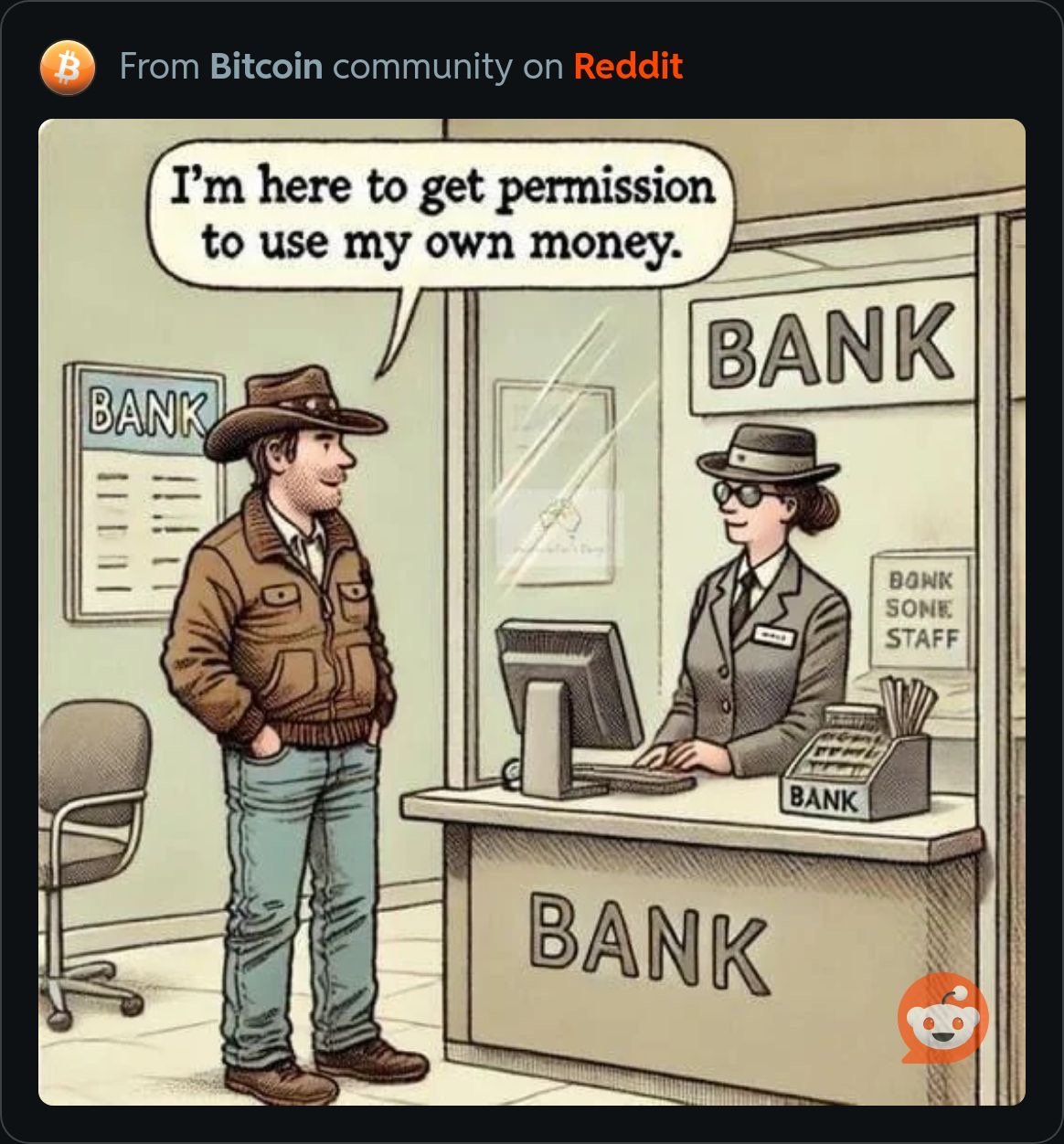

1. Early Days: A Wild West of Cryptocurrency Websites

In the early days of cryptocurrencies, websites primarily served as platforms for enthusiasts to share information and exchange ideas. These websites often had limited functionality and lacked the polished user experience we see today. Moreover, Google's understanding of cryptocurrencies and their relevance was in its nascent stages, resulting in a less refined ranking algorithm for such websites.

2. Rise of User-Friendly Exchanges and Wallets

As cryptocurrencies gained mainstream attention, user-friendly exchanges and wallets emerged to cater to the growing demand. These websites focused on providing seamless trading experiences and secure storage solutions for digital assets. Google began recognizing the importance of these platforms and started incorporating factors such as website speed, mobile-friendliness, and user experience into its ranking algorithms.

3. Content-Rich Information Portals

With the expanding interest in cryptocurrencies, websites dedicated to providing informative content flourished. These information portals covered topics ranging from blockchain technology and cryptocurrency news to educational resources and investment guides. Google recognized the significance of informative content and began emphasizing factors such as relevance, quality, and user engagement to rank these websites effectively.

4. Regulatory Compliance and Trustworthiness

As the cryptocurrency industry matured, concerns surrounding security, fraud, and regulatory compliance gained prominence. Google acknowledged the importance of user safety and started factoring trustworthiness and security measures into its ranking algorithms. Cryptocurrency websites that implemented robust security protocols, displayed transparency, and complied with regulations began receiving higher rankings in search results.

5. The Role of Backlinks and Authority

In addition to the aforementioned factors, backlinks and domain authority became essential for achieving higher rankings in Google's search results. Cryptocurrency websites that earned quality backlinks from reputable sources and established themselves as authoritative sources of information garnered improved visibility. Google's algorithms recognized the value of external endorsements, giving rise to a competitive landscape where building a strong online presence became crucial.

6. The Emergence of User Reviews and Ratings

As user-generated content gained significance across various industries, the cryptocurrency space was no exception. Websites that provided avenues for users to share reviews and ratings of exchanges, wallets, and other cryptocurrency services became influential. Google began considering user-generated content, including ratings and reviews, as a valuable metric for determining website credibility and relevance.

7. The Impact of E-A-T

Expertise, Authoritativeness, and Trustworthiness (E-A-T) emerged as essential factors in Google's ranking algorithms across all industries, including cryptocurrency. Websites that demonstrated expertise by featuring content from reputable authors, establishing themselves as trustworthy platforms, and maintaining an authoritative presence in the cryptocurrency community experienced a boost in search rankings.

Conclusion:

The evolution of cryptocurrency websites mirrors the rapid growth and maturation of the cryptocurrency industry as a whole. Google's search engine has adapted its algorithms to keep pace with the changing landscape, prioritizing factors such as user experience, security, relevance, and authority. As the cryptocurrency ecosystem continues to evolve, website owners and operators must remain diligent in adhering to these ranking factors to ensure maximum visibility and credibility in search results. Ultimately, the symbiotic relationship between cryptocurrency websites and Google's search engine plays a vital role in shaping the accessibility and reliability of information for users in the ever-expanding world of cryptocurrencies.